Contracts for Difference (CFDs) have rapidly gained popularity among traders, offering a unique way to speculate on the price movements of a wide range of assets without ever owning them. Whether it’s stocks, commodities, indices, or forex, CFDs allow traders to profit from market volatility more flexibly and efficiently than traditional trading methods. This article explores the key advantages of CFD trading, offering a deep dive into why it has become such a prominent choice in the trading world.

Understanding CFD Trading

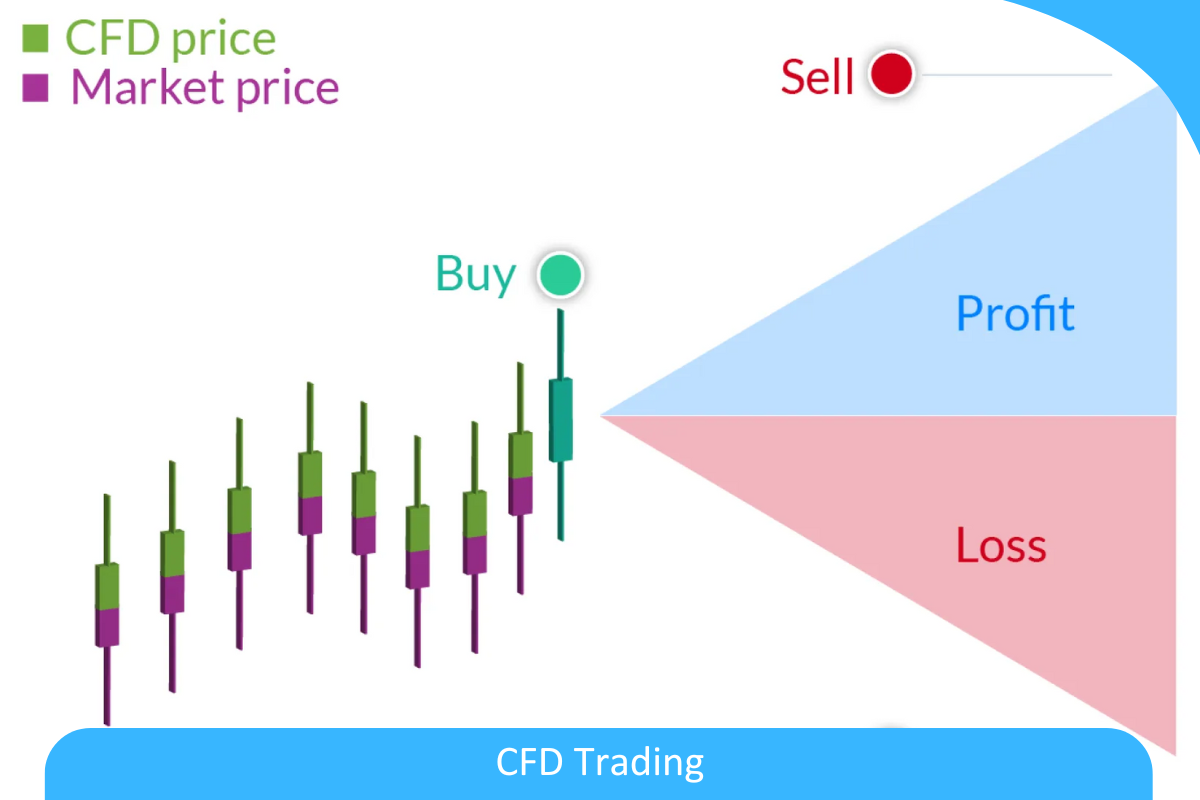

CFDs are financial derivatives that enable traders to speculate on price movements without owning the underlying asset. When you enter a CFD trade, you’re essentially betting on whether the price of an asset will rise or fall. If the price moves in your favour, you profit; if it moves against you, you incur a loss. Unlike traditional investments where you physically own the asset—like purchasing shares of a company—CFDs allow you to gain exposure to the price changes of that asset without having to deal with ownership complexities. This opens up a world of flexibility and opportunity for both new and experienced traders.

What makes CFD trading particularly attractive is the ability to leverage your trades. Leverage allows you to control larger positions with a smaller amount of capital, amplifying both your potential returns and losses. This mechanism has made CFD trading highly accessible to retail investors, but it also requires a clear understanding of how leverage works and the risks involved. Find more information with ADS broker.

Key Features of CFD Trading

A key component of CFD trading is the concept of leverage. This means that a trader can open a position by putting down only a fraction of the total trade value. For instance, if you are trading with a leverage ratio of 10:1, you can control a position worth $10,000 with just $1,000 of your capital. Leverage can significantly enhance profits, but it can equally amplify losses. Therefore, managing risk is crucial when trading with leverage.

Margin trading is another important feature of CFDs. Margin refers to the amount of money required to open and maintain a leveraged position. There are typically two types of margins in CFD trading: initial margin and maintenance margin. The initial margin is the minimum amount you need to deposit to open a position, while the maintenance margin is the minimum amount you need to keep in your account to hold the position. If the value of your account falls below the maintenance margin, your broker may issue a margin call, requiring you to deposit more funds to maintain the position or face automatic closure.

CFDs are not limited to a single market. Traders have access to a wide range of assets, including stocks, commodities, forex, cryptocurrencies, and indices, all from one platform. This makes it easier to diversify your portfolio and capitalise on global market movements. Whether you want to speculate on the price of gold, the value of the S&P 500, or the latest currency pair fluctuations, CFDs offer unparalleled access to global markets.

Advantages of CFD Trading

One of the primary advantages of CFD trading is that you don’t need to own the underlying asset to trade it. This eliminates many of the logistical challenges associated with asset ownership. For example, if you were to purchase physical gold, you would need to store it securely and possibly pay fees to ensure its safety. With CFDs, you can trade the price movements of gold without worrying about storage or associated costs.

Another major benefit is the ability to profit from both rising and falling markets. In traditional investments, profits are typically made when the value of an asset increases. However, with CFDs, traders can profit whether the market is bullish or bearish. If you believe the price of an asset is going to fall, you can sell (or “short”) the CFD and profit if the price decreases. This flexibility allows for more strategic trading opportunities, particularly during periods of market volatility.

Transaction costs in CFD trading are often lower compared to traditional asset purchases. While brokers may charge spreads (the difference between the buy and sell price), many offer zero or low commissions. This makes CFDs a cost-efficient option, particularly for short-term traders who frequently open and close positions.

Conclusion

CFD trading offers numerous advantages, including leverage, market access, flexibility, and cost efficiency. However, it is not without its risks. Traders must understand the potential downsides, such as magnified losses due to leverage and market volatility. With the right knowledge, risk management tools, and disciplined strategy, CFD trading can be a powerful way to capitalise on both rising and falling markets. Before diving in, it’s essential to assess your risk tolerance and ensure you have a solid plan in place for navigating the fast-paced world of CFD trading.